You formed an LLC to protect personal assets. Then the SBA requires your personal guarantee on the business loan. What’s the point of the LLC? Understanding what the SBA personal guarantee means—and doesn’t mean—helps you make informed borrowing decisions.

This guide explains the guarantee requirement, its real-world implications, and strategies to manage personal exposure while accessing SBA financing.

What the Guarantee Requires

Every owner with 20% or more equity in the business must personally guarantee SBA loans. This isn’t negotiable—it’s program policy. The guarantee makes you personally liable for loan repayment if the business can’t pay.

| Ownership Stake | Personal Guarantee Required? | Notes |

|---|---|---|

| 20% or more | Yes – Full guarantee | No exceptions |

| Under 20% | Lender discretion | Often still required |

| Spouse (non-owner) | Depends on state law | Community property states differ |

What’s Actually at Risk

If your business defaults, the SBA (or lender) can pursue your personal assets after exhausting business collateral. This potentially includes bank accounts, investment accounts, real estate equity, vehicles, and other valuable property. According to SBA collection policies, guarantors remain liable until the debt is satisfied or settled.

The Home Question

Your home isn’t automatically pledged as collateral just because you sign a personal guarantee. However, if you have significant home equity and the loan requires additional collateral, lenders may take a lien on your residence. This is separate from the guarantee itself—read closing documents carefully.

Managing Guarantee Risk

Smart borrowers manage guarantee exposure without avoiding it entirely. Strategies include maintaining adequate business insurance, building cash reserves for payment continuity, keeping business and personal finances strictly separate, understanding your state’s asset protection laws, and borrowing conservatively relative to proven cash flow.

When Default Happens

If trouble arises, communicate early. The SBA’s loan management resources include workout options like payment deferrals and loan modifications. Lenders generally prefer restructuring to pursuing guarantors—collection costs them money too.

Our financing advisors help you structure loans appropriately, so the guarantee represents a theoretical risk rather than a practical one.

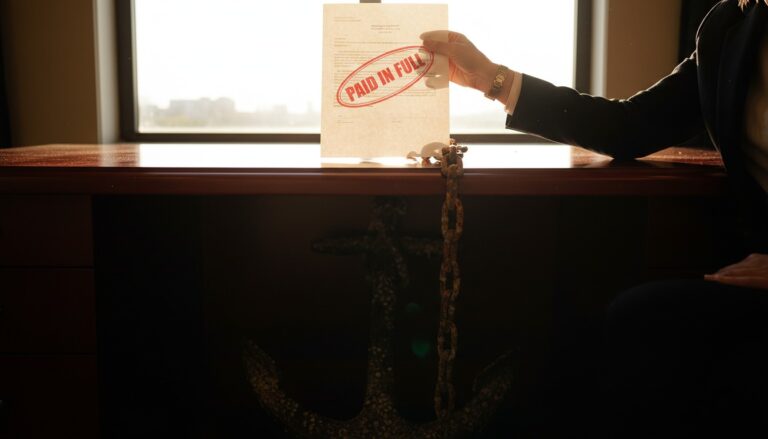

Understand Before You Sign

Get clear on your personal exposure before committing. We explain exactly what the guarantee means for your specific situation.